what is the inheritance tax rate in virginia

On a state level the tax rate varies by state but 20 is the maximum rate for an inheritance that can be charged by any state. Today virginia no longer has an estate tax or inheritance tax.

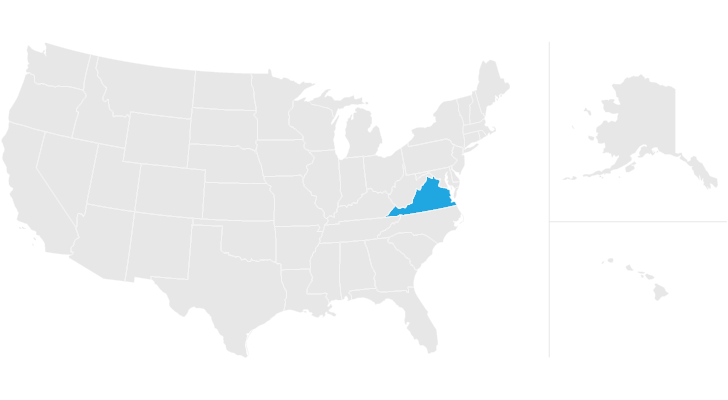

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

No estate tax or inheritance tax.

. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Virginia taxes capital gains at the same income tax rate up to 575.

This number doubles to 224 million for married couples. Maryland is the only state to impose both. Today Virginia no longer has an estate tax or inheritance tax.

Unlike the Federal Income Tax Virginias state income tax does not provide couples filing jointly with expanded income tax brackets. As the decedents niece or nephew however youd pay an inheritance tax and if you were not related at all youd pay the highest inheritance tax rate. Virginia inheritance laws uniquely include a probate tax in the probate process that is based off the value of the estate in question.

As used in this chapter unless the context clearly shows otherwise the term or phrase. However certain remainder interests are still subject to the inheritance tax. Virginia currently does not levy an inheritance tax.

An inheritance tax is one method states use to tax the transfer of wealth. Most often this is a 1 state tax and 033 local tax for every 1000 within the estate. Impose estate taxes and six impose inheritance taxes.

It is still a good idea to consult a probate attorney to minimize federal taxes. Counties in virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. Virginias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Virginias.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Tax rates for decedents who died before july 1 1999. Virginia Inheritance and Gift Tax.

So if your estate. But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level. Not to be confused with an estate tax which is payable from the estate of the deceased an inheritance tax is paid by a person who inherits from the deceased.

The top estate tax rate is 16 percent exemption threshold. There is no inheritance tax in West Virginia. Pennsylvania has a tax that applies to out-of-state inheritors for example.

An inheritance or estate tax is a tax levied on the assets of an individual at the time of his death with a higher tax rate typically charged on larger estates. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. This is great news for Virginia residents.

Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. No estate tax or inheritance tax. For deaths that occur.

Decedent means a deceased person. Virginia does not have an inheritance tax. 56 million West Virginia.

2193 million Washington DC District of Columbia. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax. Twelve states and Washington DC.

Form 92a200 92a202 or 92a205. For anyone who has received or is anticipating an inheritance following is a short guide to West Virginia inheritance tax. The federal gift tax exemption is 15000 per recipient each year for.

Theres also no gift tax in Virginia. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Virginia doesnt have an inheritance or. Tax rates can change from one year to the next.

Virginia inheritance laws uniquely include a probate tax in the probate process that is based off the value of the estate in question. Inheritance tax rates differ by the state. No estate tax or inheritance tax.

Do you have to pay inheritance tax in West Virginia. 45 percent on transfers to direct descendants and lineal heirs. These states have an inheritance tax.

The top estate tax rate is 20 percent exemption threshold. However you could owe inheritance tax in a different state if someone living there leaves you property or assets. In 2021 federal estate tax generally applies to assets over 117 million.

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. The maximum federal estate tax rate is 40 percent on the value of an estate above that amount. The income tax rate in virginia ranges from 2 to 57.

People who receive less than 112 million as part of an estate can exclude all of it from their taxes. State Tax Rates The top state rates break down like this in 2021 and 2022 excluding those who are exempt from tax such as spouses or in some states children or other close relatives. Property owned jointly between spouses is exempt from inheritance tax.

As of 2021 the six states that charge an inheritance tax. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. However certain remainder interests are still subject to the inheritance tax.

The estate tax rate is 40 so you should do everything in your power to minimize any estate tax exposure. With the elimination of the federal credit the Virginia estate tax was effectively repealed. Virginia collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

The higher exemption will expire Dec. There is no federal inheritance tax but there is a federal estate tax. Another states inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax.

The top estate tax rate is 20 percent. No estate tax or inheritance tax. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

State Estate And Inheritance Taxes Itep

Inheritance Tax In The Uk Explained Infographic Inheritance Tax Inheritance Infographic

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Retired Residents Of West Virginia Senior Care Marketing Solution Digital Marketing Agency

Stubsondemand Online Paystub Generator Tool Company Finance Federal Income Tax Company Address

States With An Inheritance Tax Recently Updated For 2020

Eight Things You Need To Know About The Death Tax Before You Die

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

2020 Estate And Gift Taxes Offit Kurman

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Your Thoughts Inheritance Tax Scrap It Or Keep It

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die